Wednesday, April 17, 2013

Sunday, March 17, 2013

QCOM - Huge volume on friday

Under 65.90 expect further weakness and a test to 200 days e.m.a.

Trading levels : 64.45, 65.17, 65.53, 65.7/9 and 66.46...

Trading levels : 64.45, 65.17, 65.53, 65.7/9 and 66.46...

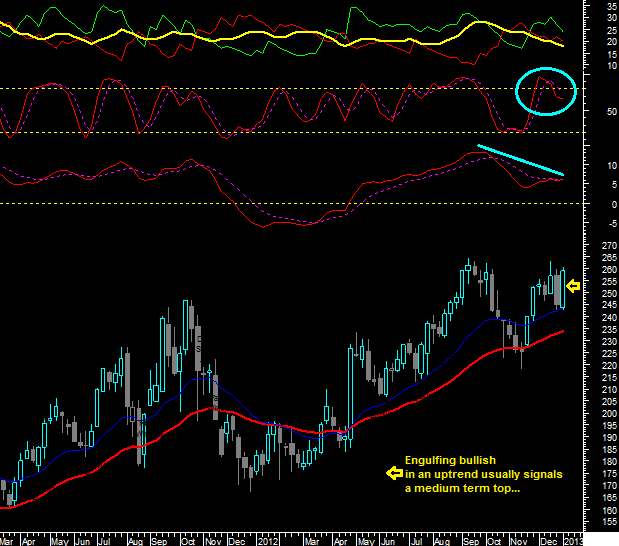

AMZN - Trading range (trading view)

Sideways trading points to a support in the 255.11/258.78 range.

Bulls must, at least, hold price above the blue line (5m chart). Then, one should expect a visit to the GAP (hourly chart).

AAPL - Again?

Can AAPL hit "200 days" this time?

For that to happen, bulls must hold 22 days e.m.a. or at least 440...

For that to happen, bulls must hold 22 days e.m.a. or at least 440...

Saturday, March 16, 2013

QQQ - Trading view

Can you see a rising wedge on the daily chart?

This is a bearish pattern, but if price can hold the 10 days e.m.a., one shouldn´t discard another move higher to at least 69.52.

Wednesday, February 27, 2013

Strong pullback from new short term lows

Keep in mind weekly and daily levels.

Can Bears finally make a score or had we another bottom and are going straight up to 1550?

Can Bears finally make a score or had we another bottom and are going straight up to 1550?

Tuesday, February 26, 2013

Simple study (saturday Feb 23rd)

Under 1495 one should expect 1466 or even 1415/37.

Keep in mind weekly chart (if) under and last years highs...

Keep in mind weekly chart (if) under and last years highs...

Sunday, January 13, 2013

QQQ - Trading view (13012013)

Can market participants become even more bullish? Sure! But there´s already a lot of optimism (sentiment update). Indeed, i think there is enough optimism to call this a medium term top...

The hanging man was followed by an engulfing bullish (bearish pattern after a rally) on Friday, but is this price action enough to call this a top?

No, its not!

Bulls are still in control, although overbought, market can extend this move up before a pullback. A daily close above 67.34 can "definitely" postpone a move down.

Short term up target above 69.20. New highs in 3/5 weeks.

If price can´t get over this area and closes under 67.06 (an hourly close would "be enough"), then bears have a chance to test medium term exponential moving averages (50 & 200 days), closing the huge gap up from January the 2nd...

The hanging man was followed by an engulfing bullish (bearish pattern after a rally) on Friday, but is this price action enough to call this a top?

No, its not!

Bulls are still in control, although overbought, market can extend this move up before a pullback. A daily close above 67.34 can "definitely" postpone a move down.

Short term up target above 69.20. New highs in 3/5 weeks.

If price can´t get over this area and closes under 67.06 (an hourly close would "be enough"), then bears have a chance to test medium term exponential moving averages (50 & 200 days), closing the huge gap up from January the 2nd...

Friday, January 11, 2013

Thursday, January 10, 2013

S&P500 - After avoiding the void...

Here is the leader testing last year highs.

As a reminder, all time highs are just 5% away, and a plunge down to March 2009 would represent a move 12 times greater than the one needed to test the highs...

From an investor perspective, and for those who care about history, where is the favorable reward/risk ratio?

Low volume and big complacency from the players should keep price unable to sustain above 1475, but don´t be stubborn as markets can extend this rally before a major top is reached...

Nasdaq-100: Hanging Man

The pattern is clear, even more important near a resistance. The Hanging man points to a top.

Obviously wrong above 2751 (on closing basis).

Sunday, January 6, 2013

QCOM - Trading plans

Keep in mind my (bearish) view under 64.45.

1st plan (Daily and Weekly charts)

Under 64.45 => 62.45/55 or even 61.86/62.19.

Sell above 64.1 targeting 62.61 and 62.21. Wrong @ 64.55

2nd plan (Hourly and 5m charts)

Under 63.73 and specially under 63.59 => 63.07 (rising 50h e.m.a.); 62.5 and 62.12

Sell above 63.50 targeting 63.05 (50%); 62.55 (25%) and 62.15 (25%).

1st plan (Daily and Weekly charts)

Under 64.45 => 62.45/55 or even 61.86/62.19.

Sell above 64.1 targeting 62.61 and 62.21. Wrong @ 64.55

2nd plan (Hourly and 5m charts)

Under 63.73 and specially under 63.59 => 63.07 (rising 50h e.m.a.); 62.5 and 62.12

Sell above 63.50 targeting 63.05 (50%); 62.55 (25%) and 62.15 (25%).

QQQ - Trading plans

Take a look at these NDX charts first.

1st plan (Daily and Weekly charts):

Under 66.47/8 => 65.13 (gap) or even 64.74 (rising 200 days e.m.a.)

Sell at 66.46 targeting 65.61 and 65.16. Wrong @ 66.77

2nd plan (Hourly and 5m charts)

Under 66.88 => 65.92 (rising 50h e.m.a.); 65.93/6; 65.75; 65.55; 65.28

Sell above 66.6 targeting 66.06 and 65.31. Wrong @ 66.91

1st plan (Daily and Weekly charts):

Under 66.47/8 => 65.13 (gap) or even 64.74 (rising 200 days e.m.a.)

Sell at 66.46 targeting 65.61 and 65.16. Wrong @ 66.77

2nd plan (Hourly and 5m charts)

Under 66.88 => 65.92 (rising 50h e.m.a.); 65.93/6; 65.75; 65.55; 65.28

Sell above 66.6 targeting 66.06 and 65.31. Wrong @ 66.91

Nasdaq-100 - Trading view

Relative weakness is a surprise in the last 4 years when talking about techs. Anyway, we can, again, be facing a new bottom.

While the weekly chart can (now) point for a bottom after a strong gap up on the 1st trading day of 2013, what should one expect in the near term? What might happen if price breaks 2713?

If NDX fails here, I will be looking to a gap close or even a new test to 200 days e.m.a.

AAPL - Trading view

This is a real Nasty chart, but what if price can hold 525/28?

Above 528 one should expect 535 or even 543 (How will look the daily chart if this happens?)

Saturday, January 5, 2013

AUD, EURO, CHF & JPY

Here are some key crosses from the risk taking appetite perspective.

AUD - Sideways : 1.01 and 1.0625

EURO - Trying to avoid the void... Must regain 1.3172. Real danger under 1.2935...

AUD - Sideways : 1.01 and 1.0625

EURO - Trying to avoid the void... Must regain 1.3172. Real danger under 1.2935...

CHF - Neutral in the range 1.0725/1.0852

JPY - Huge technical damages in this chart. Nothing to do here before some kind of pullback

Gold & Silver

We can go lower and visit long term supports, but... Watch for some bullish divergences here, specially in silver (golden retracement)

Weekly charts (stocks)

Preparing next week plans on these stocks. Medium term view; key levels

AAPL - 501; 525/527.68 key for longs...

AMZN - Bearish bias

AAPL - 501; 525/527.68 key for longs...

AMZN - Bearish bias

GOOG - 745 key for shorts, wait for some weakness to elaborate a plan

GILD - Can test the highs (>77), Strong bearish under 72.3. Tradable range in between

QCOM - 65.45 is the key level for shorts. Bearish bias under 64.45

Subscribe to:

Posts (Atom)